Saxo Bank, the online trading and investment specialist, has today published its Q3 2020 Quarterly Outlook for global markets, including trading ideas covering equities, FX, currencies, commodities, and bonds, as well as a range of central macro themes impacting client portfolios.

“Over the past three decades, after the end of the Cold War and especially with China’s momentous admission into the WTO in 2001, the world has become ever more connected and integrated through technology and globalisation. However, starting with the Trump presidency – and with a breathtaking acceleration over the space of just a few months thanks to the Covid-19 pandemic – the world is being driven by self-interest, distrust and a game of us versus them in political circles as well as companies’ supply chains” says Steen Jakobsen, Chief Economist and CIO at Saxo Bank.

“This great turning away from world-spanning supply chains, plus an impulse shading towards autarky, will bring widespread reshoring and incentive programmes to produce domestically. The first areas in focus will be medical supplies, after the embarrassingly dire lack of preparedness nearly everywhere for what was arguably an inevitable pandemic. But the new need to measure political accountability in terms of national self-sufficiency in pivotal industries will mean that energy, food supplies and technology will all be declared “mission critical”. Potential higher marginal costs for producing locally will prove less important than the political imperative to prove robust self-sufficiency. In short, prices will rise for nearly everything – and in real terms, not just through price inflation.

“This will be extremely expensive: for the consumer, for governments and for jobs. But what could prove far worse than the implications of deglobalisation is the unfortunate reality that Covid-19 has accelerated the death of free markets as the driver of economies. The move to bail out everything is understandable but deepens the risk that real GDP growth will continue to trend downwards on the zombification of the economy.

“The Covid-19 crisis was immediately devastating because our debt-saturated economies are so very highly tuned and fragile. With ZIRP, NIRP and bailouts for everyone all the time, this has been forever abolished. No more “forest fires” to leave fertile new ground for new actors to jump-start the economy and hence a future of ever-lower productivity and real GDP growth inside a massive debt burden.

“The impact on markets and employment will be extremely negative when the stimulus runs out. Through direct and indirect lending, bailouts and grants, government spending in many countries will be more than 50% of GDP. Government interests will have a strong voice in boardrooms, and new government regulations are on the way to “save the economy and jobs” with taxpayer money.

“The great irony is that although Covid-19 brings massive human and economic impacts, the even bigger risk is our response to the crisis. At best we are suspending market-based economies, at worst we are replacing them with state capitalism. That model can never ever win, as open markets are required to best drive price discovery, allocation of goods, innovation and even democracy.

“The combination of localisation, ‘my-nation-first’ and state capitalism brings massive headwinds for growth, employment, the social fabric and the markets. These approaches to tackling the Covid-19 crisis are a one-way street into a narrowminded, provincial, nostalgic narrative that states can go it alone. But fighting both the pandemic and future similar risks needs a more global approach, not a local one.”

More pain ahead for equities as the world resets

Supportive monetary policies in response to the crisis have brought fiscal and monetary institutions closer and all-out stimulus to fight the biggest economic contraction since the 1930s has fostered speculation on a scale we have not seen since 2000. However, as this is written, the S&P 500 has just had its worst session since March and the VIX has exploded higher, so the impact from Covid-19 is far from over.

Peter Garnry, Head of Equity Strategy, said: “As we enter Q3, markets remain fragile. The VIX is indicating a very volatile summer, where Q2 earnings releases will finally reveal the real damage to the corporate sector and potentially give us a rough sketch of what’s ahead.

“Valuations have bounced back to levels where the risk-reward ratio is not attractive in a historical context. History suggests that there is a 33% probability, at current valuation levels, that the international equity investor will experience negative real rate return over the next ten years.

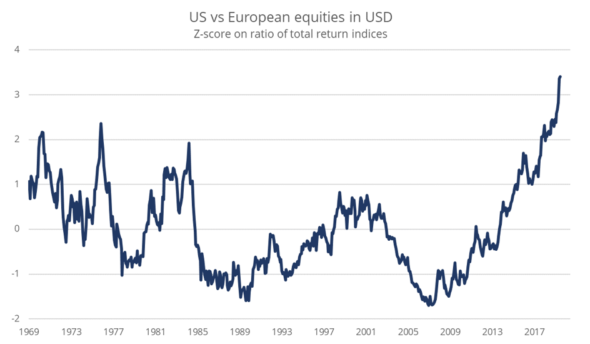

“The past year has pushed the outperformance of US equities over European equities to an extreme spread in a historical context. European equities have lost out to US equities to the tune of five standard deviations on a relative basis since 2007. The drivers have been a strong USD, higher valuations on US equities relative to European equities, higher US earnings growth combined with large buyback programmes and a tectonic shift in market capitalisation towards technology companies – where Europe has lagged. Measured on 12-month trailing EV/EBITDA, US equities are valued 65% higher than European equities. This massive valuation spread requires a flawless US earnings path from here.

“US equities generally have lower financial leverage than European companies, which is a positive in an uncertain macro environment. However, valuation is the key factor in explaining future returns, so with the historic outperformance of US equities combined with rich valuations we believe investors should begin to be overweight European equities – despite the political risks in the EU.

“Looking ahead, Localisation is an important emerging theme that we believe will play out in the next decade economically and in equity markets. One theme that makes sense in this transition is investing in small caps with a domestic revenue profile in non-cyclical parts of the economy (healthcare, consumer staples and utilities). The transition to a more localised global economy will create an uncertain path for many companies and therefore the good old strategy of investing in in high-quality companies with low financial leverage is also attractive in our view.

“We believe that certain sectors of the economy, such as the green transformation, will also continue to do well because the current economic model is a net drag on the environment. Other industries such as healthcare, robotics and 3D printing will also get a boost from policies of self-reliance and domestic-oriented production in the developed world. Companies with a strong digital presence and business model will also naturally do very well. However, with extreme valuations among some online companies’ investors should be cautious of “bubble stocks”.

Source: Saxo Bank and Bloomberg

The US dollar is still the centre of gravity

23 March marked both the top for the US dollar and the low for most major global equity indices. Since then, the Fed’s mobilisation of enormous quantities of liquidity, asset purchases and loan programmes to stop the firestorm of contagion, and the USD has returned to its trading range in the period leading up to the crisis. Despite these moves, we do not believe the market will return to normality in the near future as central banks’ response to the pandemic and shifts in international government policies pushes markets toward deglobalisation.

John Hardy, Head of FX Strategy, said: “Despite March’s market nadir and subsequent awe-inspiring comeback, we believe that markets heading back to something resembling normalcy is highly unlikely.

“We have completed a cycle of sorts. The massive ramping in equity prices – and other risky assets – and pump and dump in the US dollar are products of a liquidity bonanza that has reached its maximum amplitude. From here, the run rate of support for the economy and market will only increase again if we reach another moment of deep crisis. As we get deeper into Q3, we suspect new themes will emerge for global markets and FX beyond the risk-on, risk-off gyrations that marked much of Q2 in response to liquidity injections from global policymakers.

“Q3 may yet prove too early, but the US dollar must roll over eventually. If nothing else, because we live in a world drowning in USD-denominated debt, both onshore in the US and globally – and any durable recovery has to see a devaluation of the US dollar in real terms in the US and in relative as well as real terms in the rest of the world. The risk of widening insolvencies and defaults will encourage an outright devaluation unlike anything seen since the post-World War II debt devaluation.

“The chief question is the time horizon, but Q3 will see pressure mounting on this front. Eventually, a devaluation will be achieved through the Fed more or less surrendering independence by enacting yield caps, or some other form of yield curve control, to allow fiscal spending unconstrained by considerations for whether “the market” can absorb the usual sovereign debt issuance used to finance spending.

“In FX, the losers will be the currencies with the worst financial repression and most aggressive MMT programmes. The relative winners will be economies with significant commodity potential. Current account considerations will also loom larger than they have in the past due to deglobalisation, slower trade and possibly reduced capital flows.

“Looking away from the dominant focus on the USD, Q3 will also likely establish whether the EU is showing enough solidarity to avoid a fresh round of existential concern. But the EU budget response looks modest and late relative to the scale of the crisis, so this glint of promise will need to deepen significantly in Q3. Tighter spreads across the EU and growing signs of solidarity are required if we’re to lay our longer-term fears of a new EU existential crisis to rest.”

Gold bulls risk delayed gratification in Q3

The belief that we can and will return to normal within a few quarters will most likely turn out to be wrong and Saxo believes that this period will see low to negative growth, rising levels of debt and eventually rising inflation. The outlook for precious metals heading into Q3 therefore remains positive. However, a pandemic which is far from over coupled with a potential second wave looming over the horizon threatens to derail the recent rallies witnessed in energy and industrials, and any additional growth in Q3 will be challenged.

Ole Hansen, Head of Commodity Strategy for Saxo, said: “Gold remains the only key commodity to show a positive return so far in 2020. Following April’s rollercoaster ride it has settled into a range around $1700/oz. Gold’s ability to frustrate, then eventually reward, the patient investor is likely to be on full display during the third quarter. Multiple positive tailwinds are currently being offset by what we believe will be a short-lived decline in inflation.

“We maintain our bullish outlook for silver, and for gold now that its premium to silver has narrowed. There are several reasons to believe that gold will make a move to at least $1800/oz in 2020, followed by a fresh record high in the coming years.

“The lack of market momentum since April and the disinflationary environment currently playing out have driven a 55% reduction in bullish gold futures bets since the early 2020 peak. A positive change in the fundamental or technical outlook are likely to force traders off the fence and back into the market. This development could also see gold break higher.

“Silver’srecord cheapness to gold helped drive a strong recovery in late Q2. Our bullish outlook for gold will take silver higher. But given its often-volatile behavior, and the current growth outlook, we think silver may struggle to recover more ground versus gold. The gold-silver ratio, a key measure of relative strength, may in a best possible scenario reach 95 ounces of silver to one ounce of gold. A major second wave of the pandemic, however, may see it weaken back towards 110 – reflecting a 10% underperformance from current levels.

“HG Copper’s recent recovery to pre-pandemic levels will challenge the metal’s ability to reach higher ground in Q3. A recovery in Chinese demand combined with supply disruptions at mines in South America were the triggers that finally forced speculators back into long positions following the break above $2.50/lb. The risk of a second wave – especially in the US and China, the world’s two biggest consumers – may force a rethink and we see no further upside during the coming quarter.

“The outlook for crude oil demand remains challenged by the not-yet-under-control Covid-19 pandemic. While OPEC+ have made a gigantic effort to support the global market through record production cuts and high compliance, the potential for crude oil to reclaim further ground will be limited during the second half of 2020.

“Cross-border travel restrictions by land and air remain in place around the world, and with millions of workers unlikely to get their jobs back anytime soon, any recovery in oil demand may prove slower than expected. Even at this early stage, some are starting to speculate whether global demand reached a peak in 2019 from where it will begin to decline as the way humans and countries behave and interact with each other change.

“A second wave will not generate a repeated demand shock similar to the one witnessed during April. Most countries will instead opt to keep as much of their economy open as possible, given that the economic fallout would be even worse. The collapse back in April, however, still highlights oil’s ability to overshoot. While we expect the price of Brent to recover back to a $50 to $60/b range in late 2020 or early 2021, the short-term outlook points toward consolidation, with the price potentially spending most of the third quarter within a $35/b to $45/b range.”

Europe’s green relocation dream

The coronavirus pandemic has highlighted Europe’s overdependence on Asia, particularly China and India, for the production of medical equipment and devices as well as the key active of commonly used drugs. To regain autonomy, Europe needs to adopt a coordinated approach to create economies of scale and reduce, as much as possible, the inherent costs associated with the relocation of value chains.

Christopher Dembik, Head of Macro Analysis for Saxo, said: “The crisis served as a wake-up call to European governments and society on the urgent need to diminish economic and health dependence on the rest of the world. Reshoring of value chains is not a new idea; it is as old as globalisation itself. But it has swung back into fashion in recent years on the back of rising protectionism – and it has gained more ground over the past few months due to the outbreak.

“In theory, relocation is a very attractive idea – the question is whether Europe has the means to realise its ambitions and become more self-reliant. The euro-area balance of trade provides us with initial answers. The Euro-area trade is characterised by a massive surplus, mostly due to Germany reaching a EUR 338-billion surplus in the twelve-month period to March 2020, which represents roughly 2.8% of euro-area GDP. This is the second biggest trade surplus in the world, behind China.

“Even if Europe can regain autonomy, relocation is far from the miracle solution that many claim it to be. At the very least, it requires resources, skills, leadership, and a tolerance for higher and assumes that host countries have the requisite workforce and know-how. Creating a vibrant industrial base requires long-term vision, political leadership and the capacity to work hand-in-hand with the private sector. Relocation cannot be decreed; it is built over time. It involves long and risky processes – including reorganising value chains, which can take years.

“It is essential to adopt a coordinated European approach to create economies of scale and reduce, as much as possible, the inherent costs associated with relocation. The least we can say is that Europe is not heading in this direction.”

The Great Rewind

The Covid-19 pandemic has exposed the vulnerabilities embedded in maintaining “just-in-time” production and moving forward, businesses will focus on adding resiliency to supply chains via localisation and regional ties. This is a trend which is playing out in Australia at all levels as the gap between the markets and Main Street widens. However, Australia is in a prime position to enact and benefit from the diversified and inclusive growth required from this economic recovery.

Eleanor Creagh, Australian Market Strategist for Saxo, said: “Australia – as a small open economy with high energy and labour costs and an obsolete manufacturing sector – is in many ways swimming naked as the tide goes out on globalisation. Much will depend on the resultant policy response following a new Federal Government manufacturing task force that has been engaged on this issue.

“The shift towards self-sufficiency is not just playing out at a company level, but a country and consumer level also, as nation states incentivise self-reliance and reshoring via the localisation of production capabilities.

“For Australia, the focus should turn to the rebuild, not budget repair and winding back stimulus measures. Covid-19 should act as a catalyst for doubling down on revitalisation as opposed to central bank profligacy.

“When we talk about deglobalisation and reshoring, the concept of comparative advantage is often lost. However, Australia has a clear comparative advantage when it comes to renewables, and nowhere has the devastating impact of climate change been more obvious than Australia this year. This provides a clear impetus for investment and fiscal stimulus targeting not just the economic crisis but also the climate crisis.

“The assumptions that have underpinned asset prices over recent years are shifting, calling time on the traditional 60/40 portfolio. Fixed income will no longer serve the buffer it once was for balanced portfolios, with yields at historic lows and the gains from convexity spent. The deglobalisation tailwind and heightened focus on economic sovereignty bring a push to local over global. The increased investment in local infrastructure, climate change and sustainability, wind and solar, energy and water security, defence and local medical infrastructure presents opportunities within the equity space – with portfolio diversification pivoted toward precious metals, alternative investments and real assets.”

Localisation, Trump & Covid-19: the best things to ever happen to China

China is facing significant economic challenges from Covid-19 and international pressures from the deterioration of relations with the US and unrest in Hong Kong. These pressures are likely to make the country more innovative and the catalyst in a shift from being export-dependent to domestic-consumer driven.

Kay Van-Petersen, Global Macro Strategist for Saxo, said: “As we look to the other side of the crisis, there will be some natural low-hanging fruit and pent-up demand as the world reopens fully, but there will also be risks: from second-wave infections, further lockdowns and more.

“What we can say with high probability is that the monetary and fiscal policies of the world will keep the accelerator pushed down on loose and accommodative policies for a long time. Liquidity is currently the primary driver with regard to the ascent of listed asset prices, with fundamentals gagged and bound in the boot of the car. At some point this will reverse, but it could be 6-18 months or even years away.

“China is facing the perfect storm of adversity and challenges, including the costs of Covid-19, US-China relations deteriorating, the west backing Hong Kong over Beijing and, still to come, a global backlash that is only set to increase once the Covid dust settles on who is to blame for all this.

“Adversity, though, will only make a country more resilient and innovative, forcing it to tap into its true potential. Trump and Covid-19 are going to be the best things that have happened to China – a function of which will spill net positive to the rest of the world – in that it will accelerate Beijing’s plans to go from being export dependent to domestic-consumer driven. It will take China’s 2025-2035 plans, which are all about technology, moving up the value chain and developing tech infrastructure, and bring them forward. Finally, it will open China’s markets and accelerate reform which has been held back by export dependency.”

To access Saxo Bank’s full Q3 2020 outlook, with more in-depth pieces from our analysts and strategists, please go to: https://www.home.saxo/insights/news-and-research/thought-leadership/quarterly-outlook